Introduction

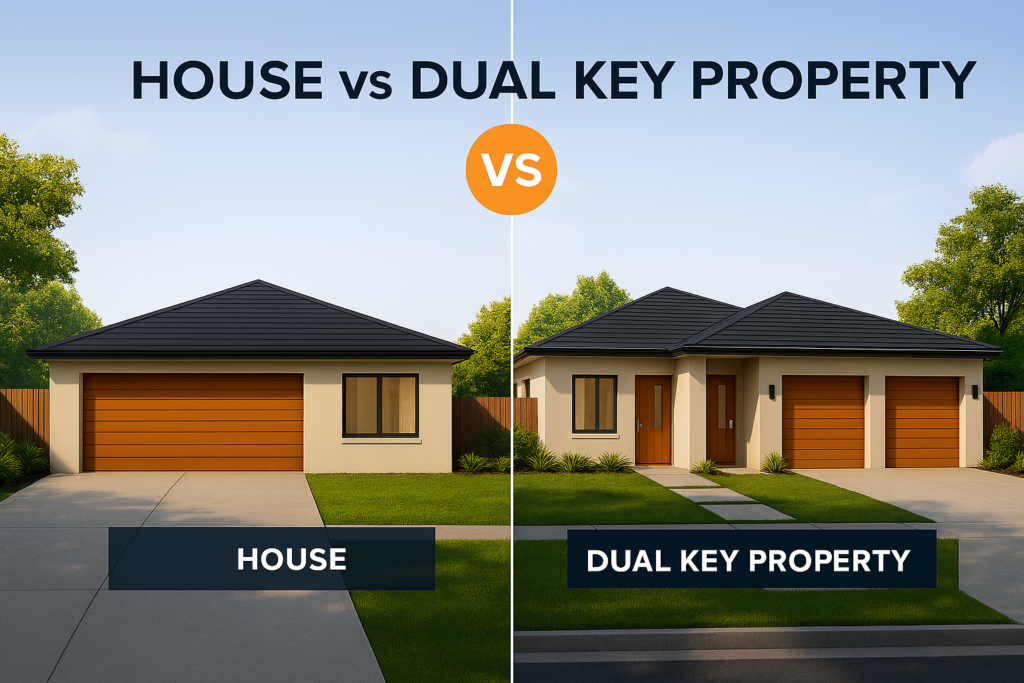

Investing in property is one of the most reliable ways to build wealth, but choosing the right type of property can make a big difference to your returns. In this case study, we compare traditional single-family houses with dual key properties to show which option delivers higher rental income, better cash flow, and lower investment risk.

1. The Challenge

Many investors struggle to decide between buying a standard house or investing in a dual key property. Traditional houses are familiar but often provide lower rental yields. Dual key properties offer two separate living spaces under one roof, allowing for higher rental income and reduced vacancy risk.

Investor Goals:

- Achieve stable cash flow

- Maximise rental yield

- Minimise risk of vacancies

2. The Properties Compared

| Feature | Traditional House | Dual Key Property |

|---|---|---|

| Purchase Price | $690,000 | $838,000 |

| Bedrooms | 4 | 5 (3 + 2 split) |

| Bathrooms | 2 | 3 (2 + 1 split) |

| Garages | Double Garage | 2 Garages (1 + 1 split) |

| Weekly Rental Income | $700 | $1,150 |

| Annual Rental Income | $36,400 | $59,800 |

| Vacancy Risk | Moderate | Low (one unit rented even if the other is vacant) |

| Maintenance | Standard | Slightly higher due to dual units |

| Target Tenant | Single family | Students, young professionals, small families |

3. Why Dual Key Properties Outperform

Dual key properties are designed to generate more income from a single investment:

- Two Units, One Roof: Rent out each section separately for maximised cash flow.

- Flexible Tenant Options: Rent one unit long-term and the other short-term.

- Lower Vacancy Impact: If one unit is vacant, the other still produces income.

- High Rental Yield: Annual gross income is significantly higher than a standard house.

4. Real Numbers: Example Comparison

Traditional House:

- Purchase Price: $690,000

- Weekly Rental Income: $700

- Annual Gross Income: $36,400

Dual Key Property:

- Purchase Price: $838,000

- Weekly Rental Income: $1,150

- Annual Gross Income: $59,800

Key Insights:

- Dual key properties provide over 60% higher rental income.

- Cash flow is more stable due to split rental units.

- Vacancy risk is lower, making it a lower-risk, higher-yield investment.

5. Investor Takeaway

For investors focused on maximising income and reducing risk, dual key properties often outperform traditional houses. While the initial purchase price is higher, the higher weekly and annual returns more than justify the investment.

Dual key properties also offer flexibility in tenant management, making them a smart choice for property investors seeking strong, consistent cash flow.

Investor Tip: If you want stable cash flow with minimal vacancy risk, dual key properties are a powerful addition to any investment portfolio.

6. Get Started

For more info, Claim Your Free Consultation Today at www.letsbuyproperties.com.au